Donor-Advised Funds (DAFs) are becoming an increasingly popular tool for philanthropically-minded individuals and families. If you’re looking to make a significant impact with your charitable giving while also maximizing tax benefits, a DAF might be worth exploring. Here's everything you need to know about how they work, what they’re not, and why they’re gaining traction in today’s financial landscape.

What Is a Donor-Advised Fund?

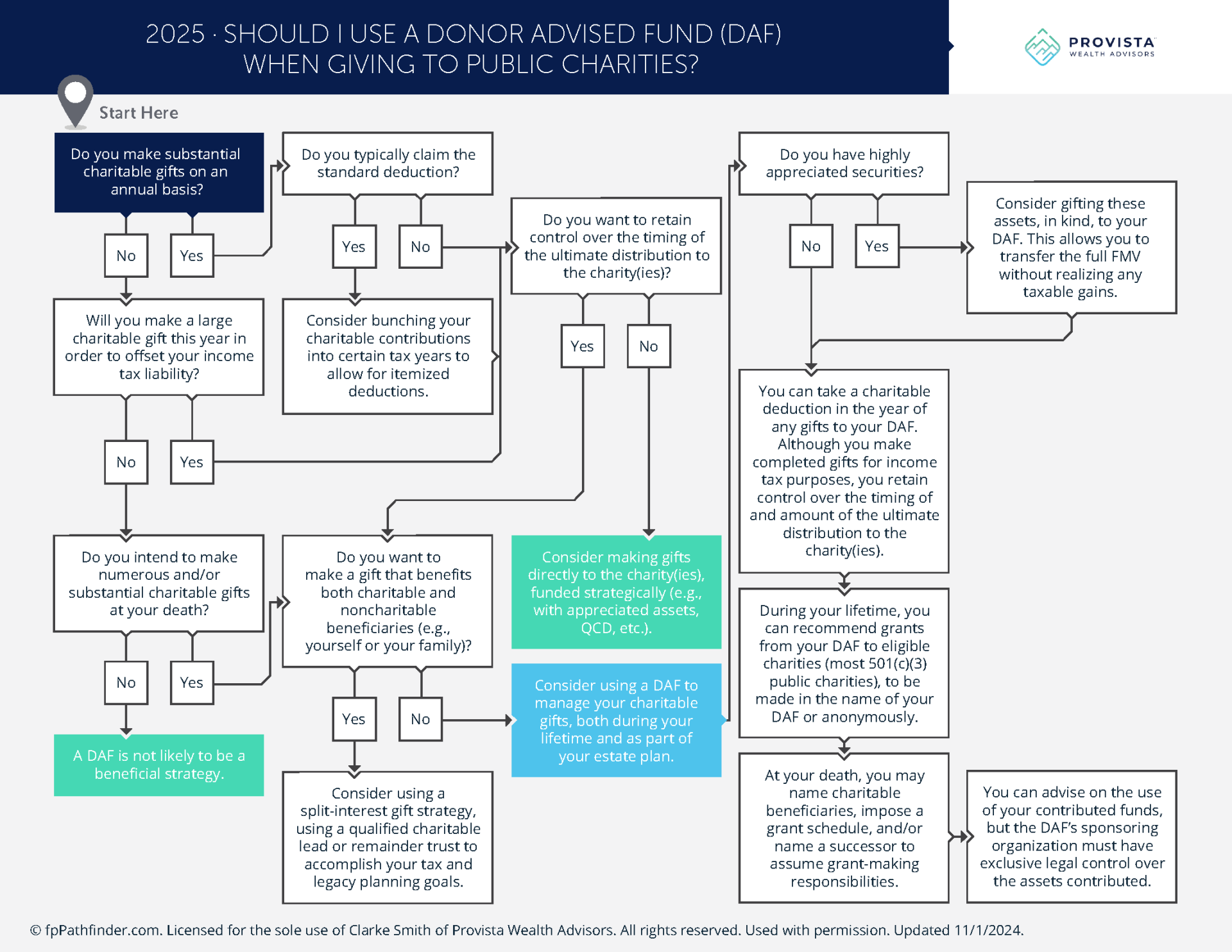

A donor-advised fund (DAF) is a private fund set up to manage charitable donations from multiple donors. Essentially, it serves as a way to make giving simpler, more strategic, and tax-efficient. Here's how it works:

- Immediate Tax Benefits, Flexible Donations: When you contribute to a DAF, you receive an immediate tax deduction for your gift—even if you’re not ready to decide which charity will ultimately receive the funds. The money remains in the fund, held in escrow, until you’re ready to recommend grants to your chosen charitable organizations.

- A "Poor Man’s Private Foundation": While private foundations are often associated with significant wealth and administrative overhead, a DAF offers a similar level of flexibility without the need for substantial assets or the administrative costs required to maintain a foundation.

- Ease of Giving: When you’re ready to give, you simply recommend a grant from the fund to your selected eligible charities. Many DAF sponsors handle all the paperwork, ensuring that your contributions go where they’re intended.

What a Donor-Advised Fund Is NOT

While DAFs offer unique advantages, it’s important to understand what they’re not:

- Not a Source of Income: Donor-advised funds are strictly charitable vehicles. Once you contribute assets to a DAF, they no longer belong to you. They cannot be used to generate income for you or any non-charitable beneficiaries.

- Not a Replacement for Traditional Giving: While DAFs offer flexibility, they’re not suitable for every donor. Some charitable contributions—like small, immediate cash donations—may be simpler to handle outside of a DAF.

Why Are Donor-Advised Funds More Popular Today?

The Tax Cuts and Jobs Act (TCJA) of 2017 made DAFs even more appealing to many donors. By increasing the standard deduction, the TCJA reduced the number of taxpayers who itemize their deductions. This change made it harder for some individuals to deduct smaller charitable contributions.

Here’s where DAFs come in:

- Bunching Contributions for Maximum Tax Benefits: With a DAF, you can "bunch" several years’ worth of charitable contributions into one year. This allows you to itemize your deductions in that year and take the standard deduction in others—essentially maximizing your tax benefits while maintaining the flexibility to distribute funds to charities over time.

Who Should Use a Donor-Advised Fund?

DAFs aren’t just for ultra-wealthy philanthropists. They’re a great option for anyone who is charitably inclined and looking to streamline their giving. Here are a few examples of who might benefit:

- Charitably Minded Individuals: If you’re committed to supporting charitable causes and want to make the most of your giving, a DAF offers an organized and efficient way to manage contributions.

- Planners with Tax Concerns: If you want to reduce your tax liability today but haven’t decided which charities to support, a DAF allows you to take advantage of immediate tax benefits while giving you time to decide.

- Donors with Appreciated Assets: DAFs are an excellent vehicle for contributing appreciated stock, real estate, or other intangible assets. Many smaller charities, such as local churches or community organizations, aren’t equipped to accept non-cash donations. By donating these assets to a DAF, you can avoid capital gains taxes while supporting your chosen causes.

Is a Donor-Advised Fund Right for You?

If you’re considering ways to simplify your charitable giving and maximize your tax benefits, a donor-advised fund might be the solution you’re looking for. Whether you’re planning to give now, later, or over several years, DAFs provide the flexibility, tax efficiency, and impact that many donors value.

To learn more about how a donor-advised fund can fit into your financial and charitable strategy, contact us today. We can help you explore your options and make the most of your giving.

Looking for more financial insights? Check out more articles at Provista Wealth Advisors for expert guidance on managing your wealth and giving with purpose.